Flex US Oil Production

The WSJ reported last week that peak US shale oil is here. Below the title they qualify “peak”: at current WTI pricing of ~$60/bbl.

The North American shale frac and drilling industry has never been more nimble and efficient. An industry that requires months or even longer to respond to commodity price changes is naturally cyclical as it overshoots or undershoots a price signal.

But in the deep corporate world of dozens of public and private companies - a depth no other country in the world can mimic for its oil industry - that complex feedback system is becoming faster. That has made the US the flex producer that responds relatively fast through an invisible hand that hold them back or waves them along.

It is fast in shutting off production. But other producers can do that, too. And within OPEC+, that is supposedly orchestrated. The difference for US shale players is that they can respond faster than ever in standing frac crews up or down.

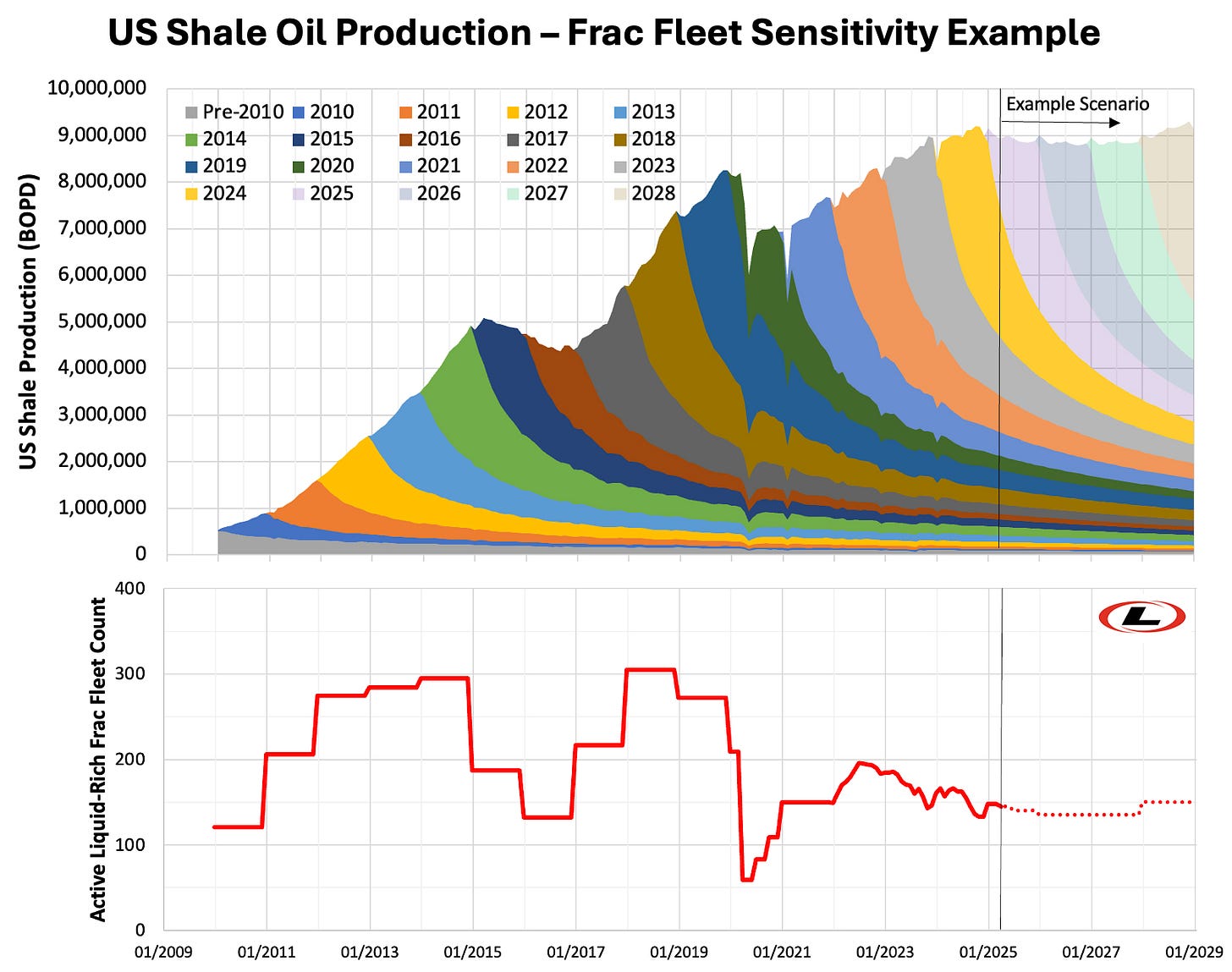

WSJ says US 2025 oil production will likely increase slightly while US 2026 production may go down 1%, or about 100,000 barrels of oil per day (bopd). In our simple bottoms-up production model, we can mimic this expected production scenario by reducing frac crews from the current 150 crews in US liquid-rich plays to about 135 by the end of 2025. This is essentially where the frac crew count was at the end of 2024.

Industry efficiencies and growth in pumps per fleet have boosted year-1 production per frac crew to 25,000 bopd/fleet. That means 135 frac fleets can produce 3,400,000 bopd - which about matches the current yearly US shale oil production decline. Thus, 135 active frac fleets keep US oil production flat.

On the other end of the current response to lower prices lies a potential quick response to add frac fleets back to work. If WTI prices would increase again, for example in 2027 or 2028, current peak oil production can relatively easily be topped. In the example scenario below I show how quickly US oil production can react when frac crew count grows by ~10% - from 135 back to about 150 frac crews by the end of 2027. By the end of 2028, assuming the same frac fleet production metric of 25,000 bopd/fleet still applies, US shale oil production could grow again by 400,000 barrels a day.

Efficiency originates from surviving the bad times. That creates resilience and an ability to peak when prices rise.