Shell has been waiting patiently for British Petroleum’s value to lag as its London rival focussed on the lower returns on capital that are normal for so-called “green” energy generation. Recently, BP has been cutting its renewable investments, but it might be too late to further boost its valuation and dowry.

Shell also experienced mission creep away from fossil fuels, but changed course earlier. During the years when renewables beyond petroleum ruled at Shell, it used different investment criteria for various energy sources: 5-10% for "renewable" energy projects, 18% for natural gas projects and 23% for oil projects. Now, with its courtship of BP, Shell is doubling down on fossil fuels, and making energy production more efficient again.

This earlier return of focus is now benefitting Shell, which can monetize on the valuation gap between the companies: since mid-2020, BP stock is up 18%, while Shell’s stock is up 150%. On a side note - no-nonsense XOM is up 200% since that time.

One interesting aspect combined assets is BPs US portfolio. Shell has never been able to make shale plays work to its advantage. It bought acreage in the Marcellus Shale dry gas play from East Resources in 2010 to sell it to sell again in 2017. Shell also sold its Permian assets to ConocoPhillips in 2021. While Shell has been very active in the diagnostics and attempting to understand fracture growth behavior and what drove production in these plays, the economics were generally sub-par. Hence its exit from shale.

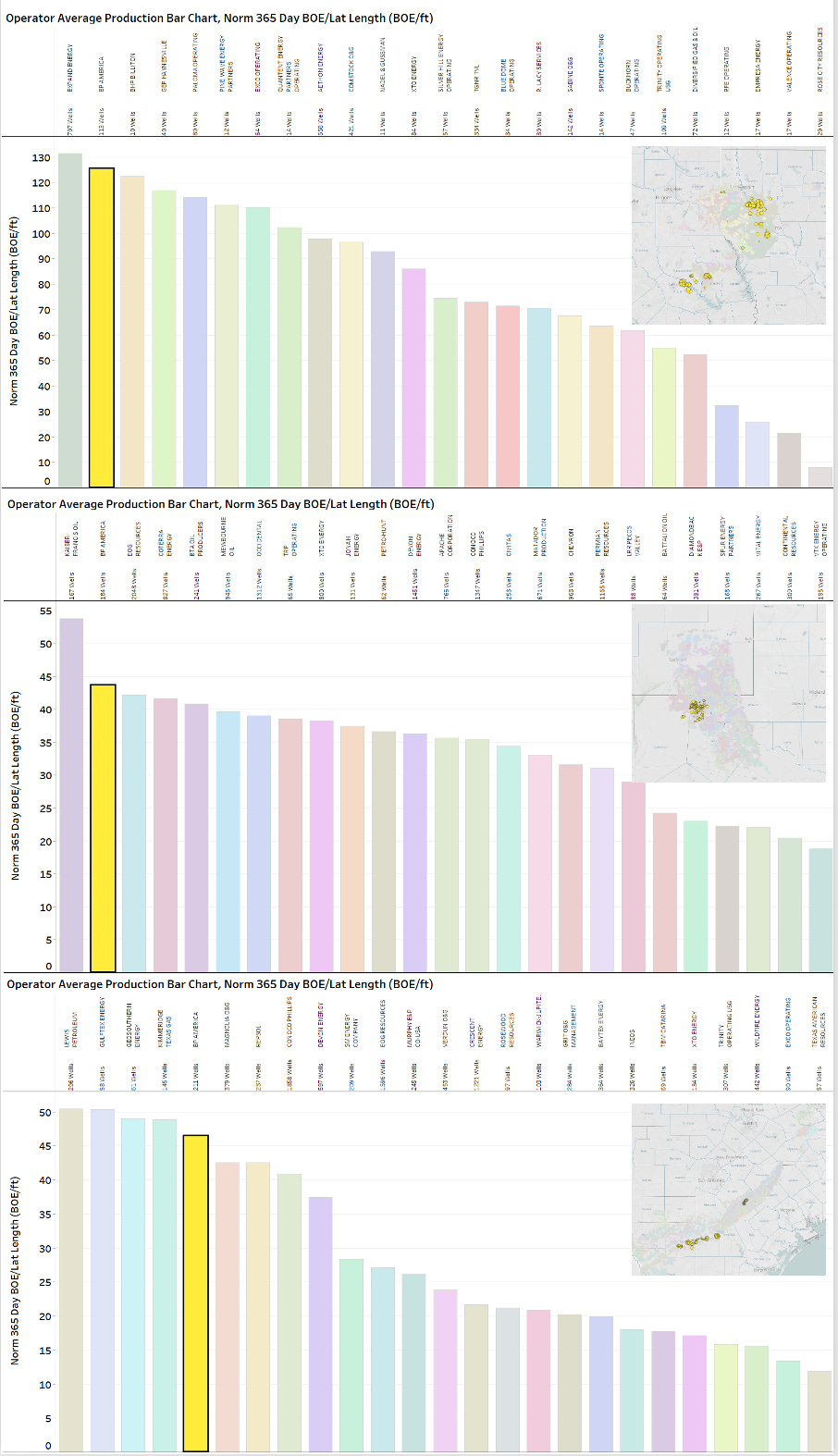

BP, through its more nimble US subsidiary BPX, has built a different experience. It has assets in the Haynesville, the Eagle Ford and the Permian Delaware. In all these shale basins, in terms of production in year-1 in barrels oil equivalent production per foot of lateral (365-day boe/ft), BPs production response ranks near the top as compared to basin peers. That’s essentially because BP has combined finding great geology with mostly middle-of-the road frac design choices.

A big question for BPX US assets is if Shell will have the appetite to manage shale again, even if it starts from a position of strength with great production results. Will these be cherished as a learning opportunity to advance this methodology elsewhere in the world, or will this prize be sold immediately?

?

Net zero is starting to compound. My bet is if: Shell doesn’t buy BP that they both delist in London and move headquarters to the Sunbelt and relist on the NYSE. Even if they combine, the UK is so anti common sense and anti energy friendly Shell will still move and relist.